Start Studying For Your Regulation Section Today For Free!

Regulation(REG)

and The CPA exam

"The Regulation (REG) section of the Uniform CPA Examination (the Exam) tests the knowledge and skills that a newly licensed CPA must demonstrate with respect to"

U.S. federal taxation

U.S. ethics and professional

U.S. business law

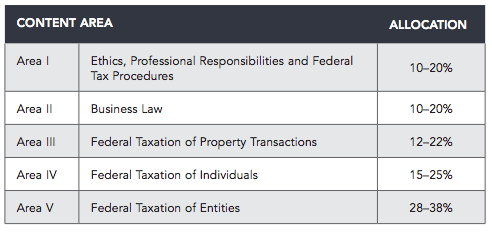

Regultion(REG) Areas & Concepts Tested

Federal Tax Procedures and Professional Ethics & Responsibilities

10% – 20% – these topics cover professional conduct, independence, and liability. Independence affects a CPAs ability to be objective.

Federal Individual Taxation

15% – 25% – covers all individual income tax topics like deductions, exemptions, gains, losses, carryforwards, carrybacks, and everything else related to the 1040 form and its schedules.

Business Law

10% – 20% – covers contracts, transactions or debt relationships, and commercial regulations. This topic can cover things like UCC or Uniform Commercial Code and various business structures.

Entity Taxation

28% – 38% – covers legal entities and the ways they are taxed like trusts, tax vehicles, corporations, partnerships, and sole proprietorships. This may draw from information from the IRC local state boards, and other regulatory agencies.

Property Transaction Taxation

12% – 22% – The differences between the taxations of a business and the taxations of an individual will be tested with subjects like an alternative minimum tax (AMT) and the importance of gross income inclusion, along with the taxations of transactions involving property and assets.

Regulation (REG)

Exam Sections & Structure

Source: Aicpa.org. (2020). [online] Available at: https://www.aicpa.org/content/dam/aicpa/becomeacpa/cpaexam/examinationcontent/downloadabledocuments/cpa-exam-blueprint-reg-section-july-2019.pdf [Accessed 14 Feb. 2020].